Executive Summary

Advisor productivity is closely tied to the amount of time advisors spend interacting with clients and prospects. The primary barrier to increased client interfacing is the time advisors spend in “extensive” or “comprehensive” financial planning. Advisors increasingly engage in extensive planning for various reasons including:

• The desire to demonstrate value to prospective clients

• Shifting consumer demographics and demand

• Increasing commoditization of investment advice and other financial services

While the tools available to assist advisors with planning address an increasing number of financial topics (breadth) they also require extensive advisor time, resources, and competency (depth) to use.

By using Elements, an advisor can be “comprehensive” (breadth) without expending unnecessary time and resources. Advisors who use Elements need not have the same level of financial planning competency in order to be effective holistically.

• The implications for this are far-reaching

• Ability to demonstrate value quickly in prospecting

• Shorten time to onboard new clients

• Quicker answers to financial questions

Human Interaction – The Key to Advisor Productivity

It’s long been accepted that financial advisors’ highest value activity is in front of clients and prospects building relationships.

In fact, in the Kitces Research 2022 survey, they found that advisors who generate more than $1 million in annual revenue spend 39% of their time in front of clients and prospects, whereas their less productive counterparts (those who generate less than $1M of revenue) spent only 29% of their overall time meeting with clients.

> 💡 On average, advisors who generate over $1M of annual revenue spend 39% of their time interacting with clients and prospects

Looked at from a different angle, we can take this snippet from the actual report:

While on the one hand, shifting another 10% of a workweek toward more client- [or prospect-] facing time may not seem significant – it amounts to a little more than 4 hours per week, with less-productive advisors averaging 6.4 hours of weekly client meetings versus 10.8 hours for the most productive advisors … over the span of a year, an extra 10% of time allocation permits the most productive advisors to add nearly 200 1-hour client meetings per year, allowing for a substantively deeper level of client relationship by sheer virtue of increased meeting and contact frequency.

What is the primary hurdle to spending more time with clients? Creating a comprehensive financial plan.

Comprehensive Planning – Can’t Live With It, Can’t Live Without It

According to Kitces Research, the primary hurdle keeping advisors from spending more time interfacing with clients is the process of comprehensive financial planning:

What is the most overwhelming dominant challenge for advisors aiming to succeed at financial planning? It’s that the process is time-consuming. More so than how to do financial planning, the greater concern for the typical advisor is simply how to make time for what it takes to deliver financial planning to each and every client. The prioritization is entirely rational.

This becomes a more widely spread problem as many financial professionals, regardless of their service offering (i.e. financial planning, investment management, insurance, etc.), are pressured to be more comprehensive in the topics they address with clients and prospects. Some of these factors include:

• The desire for financial professionals to demonstrate value to prospective clients

• Shifting consumer demographics and demand

• Increasing commoditization of investment advice and other financial services

To make matters more complicated, according to Kitces on average it takes financial professionals 10 hours to create a comprehensive financial plan. Thus, if financial professionals feels pressure to be “comprehensive,” they can expect to allocate a lot of time and resources that may ultimately keep them from interfacing with clients.

> 💡 On average, advisors take 10 hours to create a comprehensive financial plan

Even with the rapid innovation of technology, and while the tools available to assist advisors with planning address an increasing number of financial topics (breadth), these tools require extensive time, resources, and competency (depth) to use.

Traditional Planning Tools – The Great Time Suckers

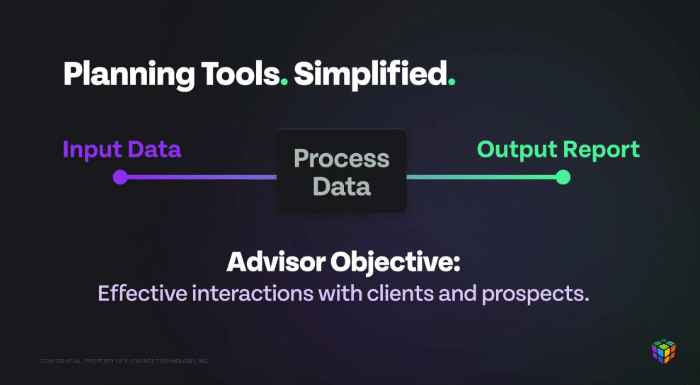

As with most tools used to add value to clients, Traditional Planning Tools (referred to as TPT) follow a three-step process:

1. Gather data

2. Process data

3. Present data to be used by the financial professional and client

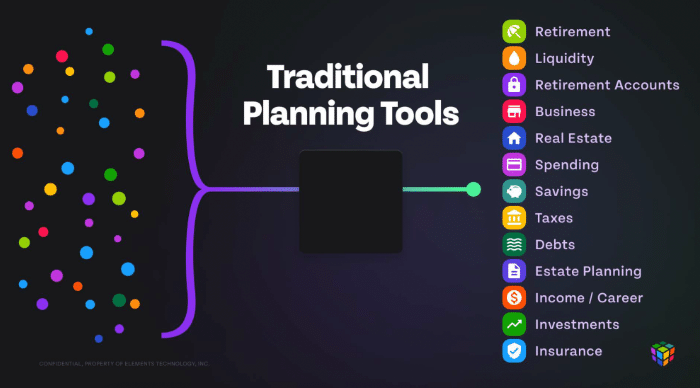

In an effort to be comprehensive and cover a broad amount of financial topics, most TPT gather as much information as possible and present that data summarized by topic (as shown below). While this approach provides a breadth of information and a depth of subject matter (by topic) it’s rarely valued by clients.

The financial professional must then overlay this process by prioritizing, filtering, and simplifying the data and the output for the clients. This process, according to Kitces, can take advisors about 4 hours to complete on average, and when compared to time spent in other tools “third-party planning software is double or more than the time spent with other technology tools used to support plan production.” (Kitces Research…)

> 💡 On average, financial professionals spend 4 hours in traditional planning software to create a comprehensive financial plan

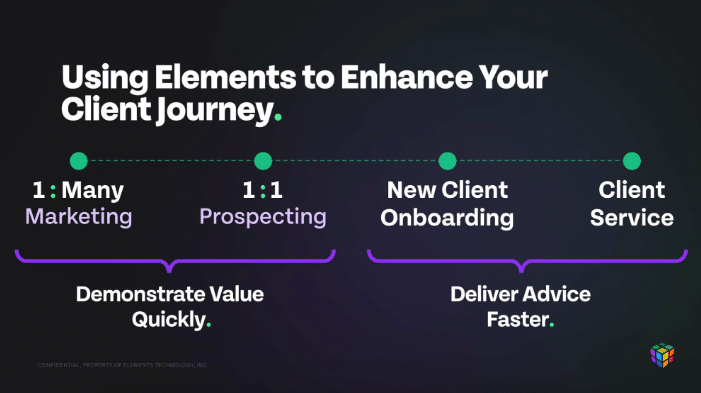

So what are financial professionals to do when facing a situation in which time is limited, a comprehensive financial view is needed, and value needs to be delivered? This conundrum appears in many situations including:

• Demonstrating value to prospective clients

• Onboarding clients faster

• Providing advice quicker to existing clients and responding to questions rapidly

At Elements, we’ve found a better way to provide financial professionals with a comprehensive view of clients’ financial health without the hours of work usually demanded of them to create that.

A Better Solution – Breadth Without Unnecessary Depth

Historically, the breadth and depth of a financial plan have been inseparably connected – generally professionals couldn’t have one without the other. We created Elements for financial professionals to use when time is limited, a comprehensive financial view is needed, and value needs to be delivered.

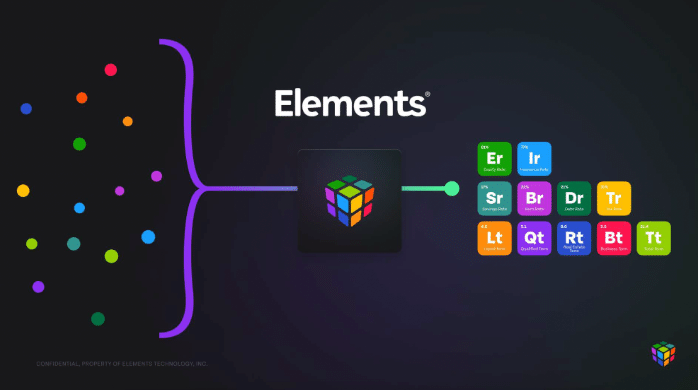

By prioritizing and filtering out unnecessary data, Elements is able to be hyper-efficient in the data-gathering process. In our experience, it takes clients less than 10 minutes to fully onboard to Elements and create their Elements scorecard. What’s more, the process is more collaborative than traditional planning tools – we don’t expect clients to have all the answers all at once.

> 💡 With Elements, it takes clients less than 10 min to onboard and produce a comprehensive scorecard

The resulting output is a clean, focused and comprehensive view of a client’s financial health – we call this the Elements Scorecard. This scorecard acts as the “vital signs” that financial professionals can use to quickly assess a client’s situation and provide insightful, relatable and valuable observations.

By reducing the amount of time needed to provide financial professionals with a comprehensive financial view, the results are far-reaching:

• Advisors are able to demonstrate the value of financial advice faster to prospective clients

• Advisors see a reduction in time investment required to provide timely, personalized advice

• Advisors can serve a higher volume of lower-cost clients (often accumulators with less assets) and still offer comprehensive financial advice

• Advisors can offer rapid responses to financial questions

• Advisors create a service offering that’s better aligned with what clients actually want – peace of mind and financial confidence

Spending less time creating a comprehensive financial plan means financial professionals have more time doing things that actually move the business forward – interacting with clients and delivering value.