You’re buried with client work and practice management. You’re working long hours, your discretionary time is limited, and you need to get some help. Who should you hire next? How do you sequence the right role at the right time?

I’ll share what I did because it worked. But I’d recommend you take a much different course.

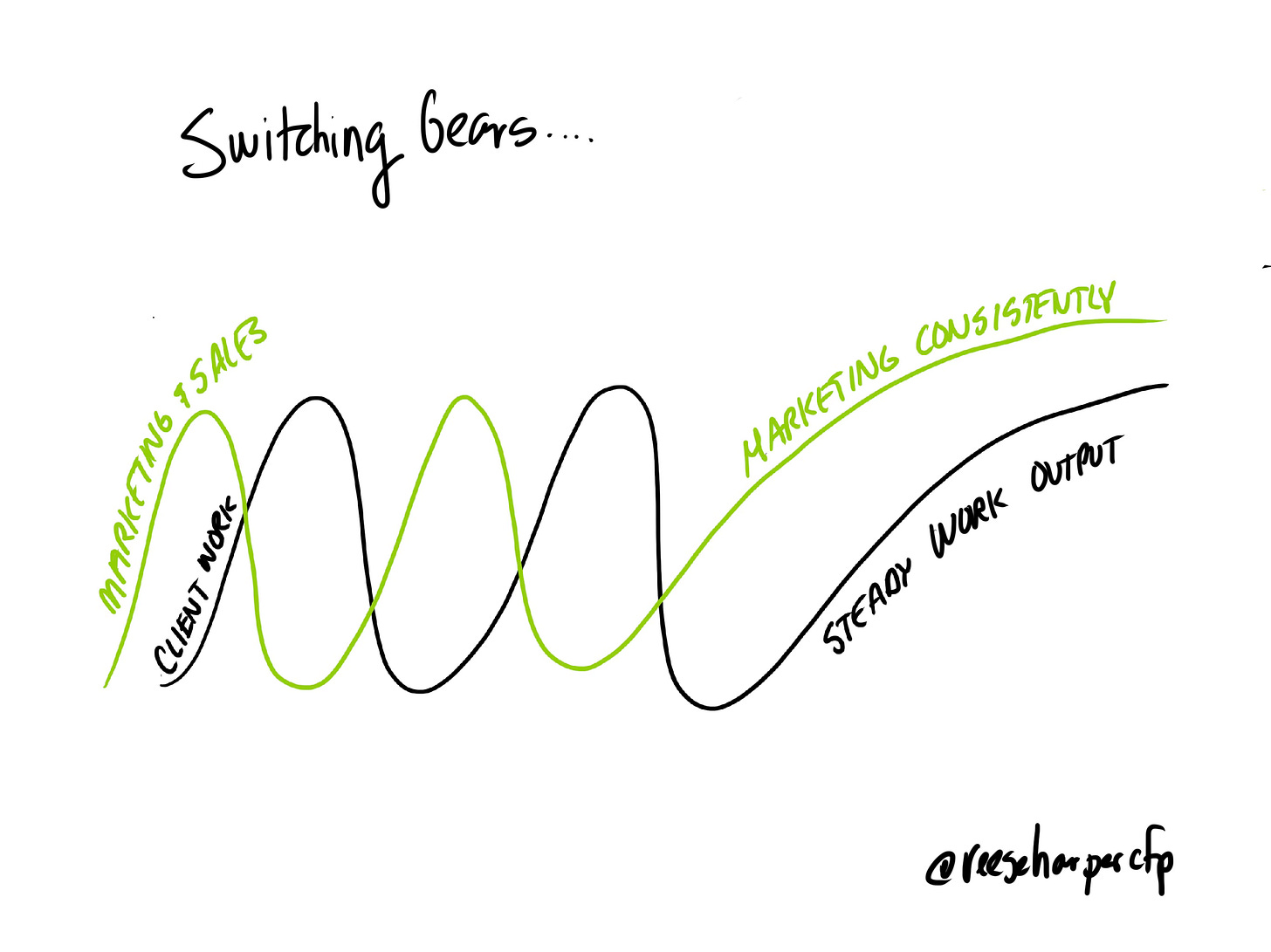

Whenever I felt overwhelmed by the work, I added support staff to increase my capacity. Then I focused on completing the work and improving my planning process. I started to notice a pattern. During my first few years, I concentrated on either 1) doing work, or 2) finding clients. But I neglected a consistent, repeatable effort towards marketing or sales.

As I learned later, most firms neglect a consistent marketing and sales effort in the early years, as I did. They wait too long to get serious about building a replicable marketing engine.

There is a better way! If I could give my younger self some business advice, here’s what I would say. Ramp up demand to the point that you’re feeling crushed, then bury yourself just a little bit more. You can always stay up late doing the planning work. You have those skills. On the other hand, generating new clients should be a core competency in your practice so you can easily support any new operational hires that come on board, especially a new advisor.

This is hard to do—it might drive you nuts for a while—but the end result is greater efficiency, improved growth, and even higher quality planning. Here are seven reasons why I prefer focusing on marketing over operations early on:

1. Marketing is harder than operations. As you know, clients stick with their advisors around 90% of the time. But advisors fail at surprisingly high rates—as high as 80% after 3-4 years. In other words, it’s hard for most advisors to get clients and thrive. But once you get them, you’ll most likely keep them. The key to survival is getting enough clients to make the business work.

2. More clients means more business model options. When you’re generating lots of high-quality clients, you can implement a waiting list, raise prices, or build less complex service models for junior team members to deliver. When firms hire advisors before they have enough demand, they feel pressure to keep those advisors busy to justify salaries. That usually looks like paraplanning tasks and suboptimal client work. Instead, crank up your growth engine and build exactly what you envision.

3. Increase your valuation earlier. New clients and new revenue increase your practice valuation. Capacity does not. As your valuation increases, you can access capital through private lending, or raising private equity to accelerate your growth.

4. Hire who you’re not. You have advisory skills to deliver plans. You can be your own assistant by simply working more hours for a while. But it’s unlikely you have the experience to manage a consistent marketing campaign, and you definitely don’t have the time. It makes more sense to “buy” a marketing agency, or marketing FTE, allowing you to focus on your service model while you ramp up demand. This way, you’ll be intimately involved with the marketing program, you just won’t have to project manage or be responsible for all of the executables.

5. Service emotional jobs efficiently and spend less time on the phone. When you implement a quality marketing campaign, prospects screen themselves and move through the buying cycle without your having to talk to them. Most clients hire and retain FAs for emotional jobs, not functional ones. One of the best ways to service emotional jobs is through a strong marketing campaign. This means serving up confidence through written and visual communication. Strong marketing influences your internal messaging for current clients, which improves retention and referrals.

6. Differentiate yourself from generic competition. The wealth management business requires differentiated marketing more than ever. Large firms are competing for the same generic customer through intense digital marketing campaigns. Word-of-mouth referrals will always be a part of growth, but robo-advisors, D2C fintech, and large custodians are competing more actively for Gen XYZ customers. A quiet, unfocused service business can’t thrive like it used to. But those who niche down and actively market offer a strong value proposition against generic alternatives. Niche businesses grow faster and retain clients even better.

7. Attract advisors to your firm. Solid marketing attracts better advisors. Most advisors don’t want to focus on sales. They know about the high failure rates. Provide a steady stream of new customers, and you’ll have your pick of the hiring pool. If you can provide a client who is qualified through your marketing funnel, and philosophically aligned with your firm, you will have done the hardest part. Advisors are willing to pay for that convenience in a variety of ways, and they love joining forces with a focused firm that will help amplify their warm market.

To sum things up, hiring an advisor is a serious commitment of cash. You can handle that overhead much easier with a steady stream of new clients. The hardest part about ramping up a new marketing program is watching all your hard-earned dollars go up in smoke for a while. You’ll make mistakes, but they will lead you to the right answers for your niche in time.

Hire part time, contract with an agency, or bring on an experienced FTE. Just scale up using a budget that is reasonable for you, and stick with it for an extended period of time. Evaluate the results of your spending each month and make adjustments.

Once you’re slammed with a waiting list and have a replicable marketing program—then and only then—hire that next advisor.

Subscribe to Reese Harper’s Substack here!