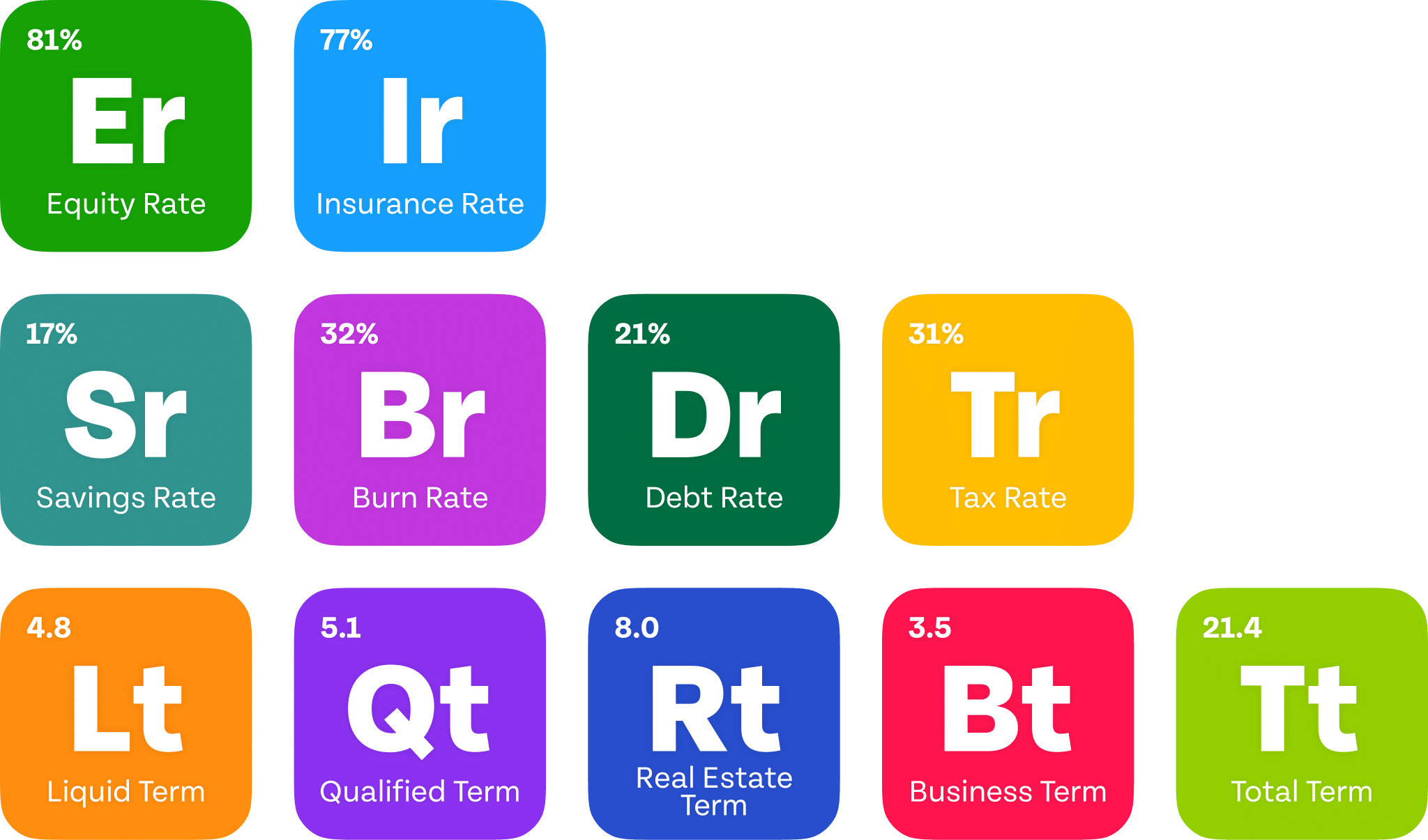

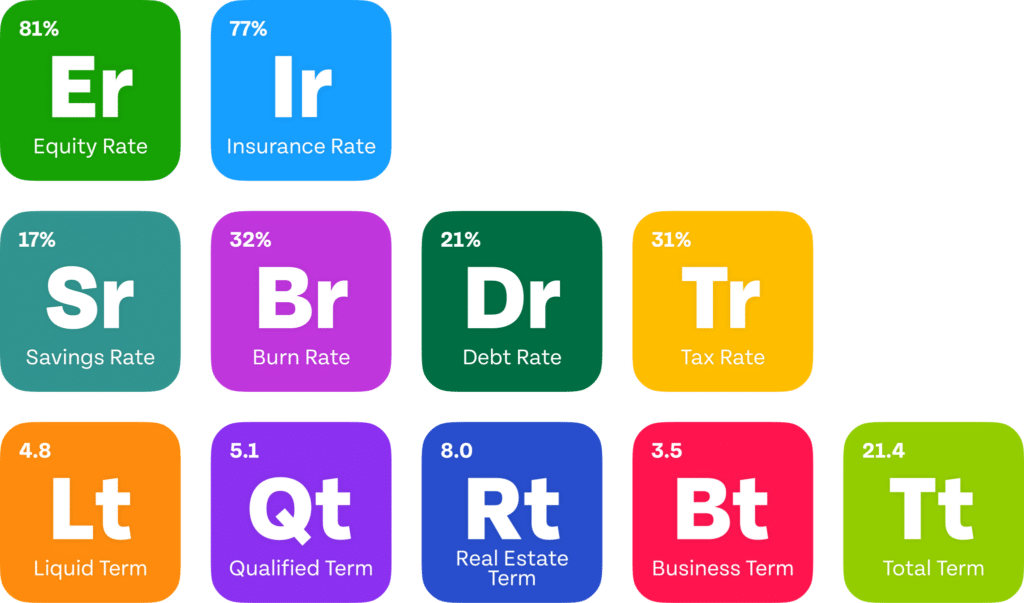

The Elements Financial Vitals is a comprehensive system designed to revolutionize the way financial advisors assess and monitor their clients’ financial health. This system is particularly valuable for advisors working with clients in the accumulator stage of their careers, emphasizing efficiency, modern solutions, and clarity in financial planning. Here’s a detailed explanation of how the Elements Financial Vitals work, focusing on the purpose of each Element:

Equity Rate (Er): This measures the proportion of a client’s investable assets held in equities, which is crucial for understanding volatility risk relative to the client’s age and spending. It helps advisors gauge the suitability of the client’s investment mix and risk exposure.

Insurance Rate (Ir): This Element evaluates the adequacy of a client’s insurance coverage (life, disability, business, liability) relative to their annual spending and net worth. It’s essential for ensuring clients are adequately protected against potential financial risks.

Burn Rate (Br): Representing the percentage of annual gross income spent on personal living expenses, the Burn Rate is vital for understanding a client’s spending habits and their impact on long-term financial goals.

Tax Rate (Tr): This indicates the portion of a client’s gross income allocated to tax payments. It’s a key metric for effective tax planning, helping to ensure clients are not overpaying taxes and are taking advantage of available tax-saving strategies.

Debt Rate (Dr): The Debt Rate shows the proportion of gross income allocated to debt payments, providing insights into a client’s debt burden and its impact on their financial well-being.

Savings Rate (Sr): This measures the percentage of gross income saved for future use, a crucial indicator of a client’s ability to build wealth and prepare for future financial needs.

Business Term (Bt): It estimates how long a client could sustain their lifestyle using current business equity, assuming no asset growth or decline. This Element is particularly relevant for business owners, offering insights into the financial health and sustainability of their business assets.

Real Estate Term (Rt): Similar to the Business Term, this metric estimates the number of years a client could sustain their lifestyle using current real estate equity, under static conditions. It’s valuable for understanding the role of real estate in a client’s overall financial picture.

Qualified Term (Qt): This Element provides an estimate of the years a client could sustain their lifestyle using qualified retirement assets. It’s a crucial measure for retirement planning, indicating the adequacy of retirement savings.

Liquid Term (Lt): This measures how long a client could sustain their current lifestyle using liquid assets. It’s vital for assessing a client’s liquidity and short-term financial security.

Total Term (Tt): This gives an overall estimate of the years a client could sustain their lifestyle using all current assets. It’s an overarching metric that combines insights from all other Elements to provide a comprehensive view of a client’s financial health.

Each Element in the Elements Financial Vitals System offers a unique and critical perspective on a client’s financial health, enabling advisors to provide more tailored, efficient, and effective financial advice. This system empowers advisors to help their clients make smart financial decisions, benchmark financial health against objective standards, and reduce time spent in meeting preparation and data analysis.