Hi Friends! I wanted to send y’all a quick message going into the weekend. It’s been a beautiful week—weather, conversations, and stories. I wanted to share something I learned that I hope you find helpful. [I’ve altered the name, and a few details in this story to protect identities].

I try and schedule “dinner” with clients at least once a year. It makes the whole “meeting” thing much more personal. I let them pick the venue, and we have a good time catching up on life.

Recently, I went to dinner with a client who I’ve been working with for years. He’s divorced now, and this has created some emotional challenges. We spent the first chunk of the meeting talking about a new girlfriend, his amazing kids, and the values he is pursuing to bring joy into his life.

I honestly think it was the first time in a long time that he felt truly heard. It was rewarding to listen, and just hold space for him as he unpacked what has been a challenging time.

About three-quarters of the way through the meeting, after eating some amazing food, we started chatting about some of his financial concerns.

“Reese, with everything happening right now, I’m just not sure if I’m going to be okay. With the state of the world…(I’m sure you can fill in the blank here 🙂 ).”

The market was down, and he was understandably concerned. Would he be forced to go back to work? Sell his vacation home? Should he invest in a new startup he was contemplating?

Prior to this meeting, he spent about two minutes making sure his data was accurate in Elements so I could have an accurate view during our meeting. No “full plan.” No binder, printouts, laptop, or supporting economic commentary. There was NO preparation for the meeting. Everything we needed to discuss was on our phones.

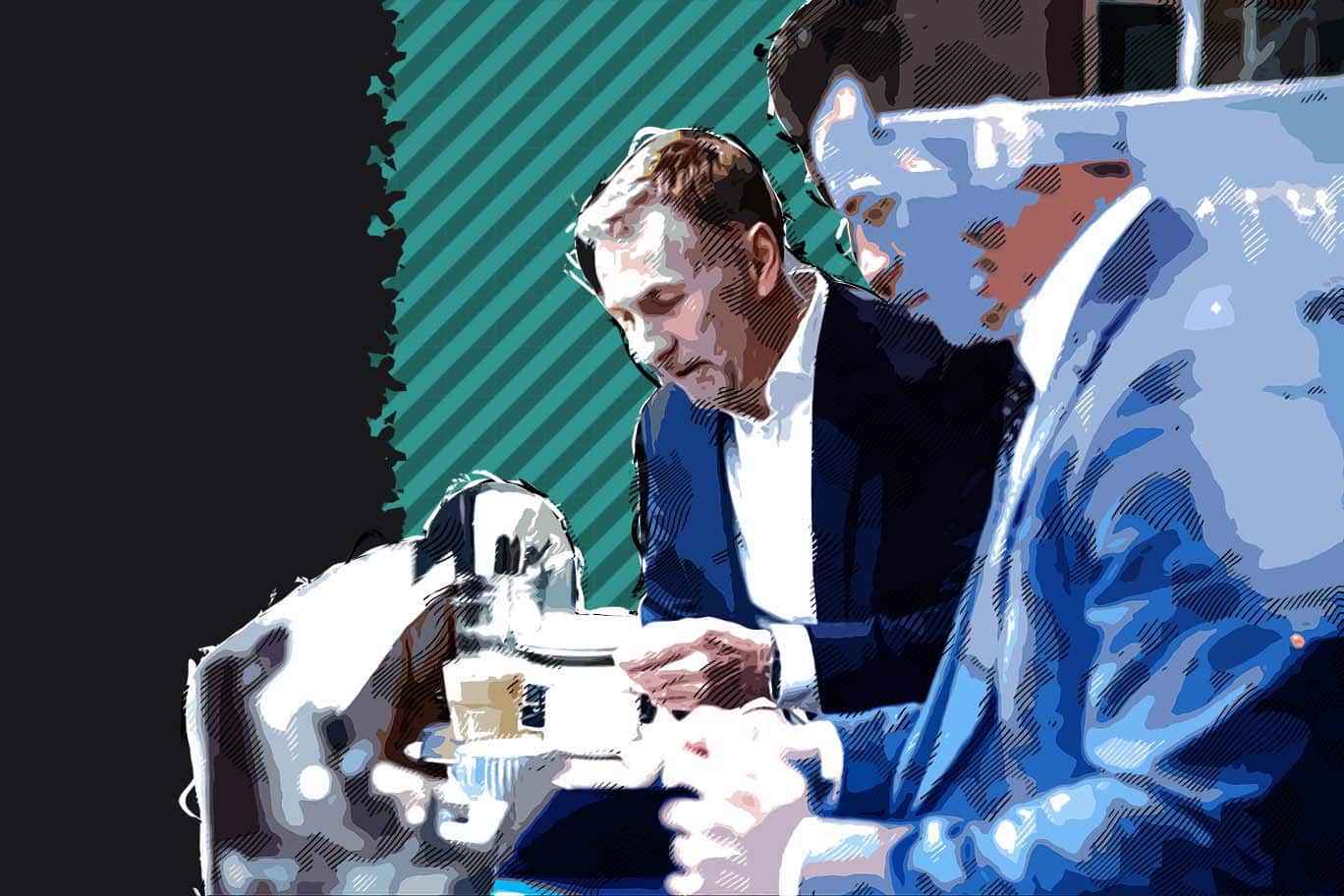

We both pulled out our phones and opened up his Elements® scorecard to help serve as a visual reference during our conversation.

I asked him to click on his Total Term (TT) Score (a concept we’ve discussed many times). The screen showed a simple calculation: net worth / current annual spending. Essentially, an estimate of the number of years he could spend down his entire net worth. He also looked at the subcategories which are measured similarly (Liquidity, Retirement Accounts, Real Estate).

[These are not his numbers 🙂 ]

I asked him how he felt about the Total Term number? He looked a bit surprised and said, “Hmm… it looks pretty good. Do you think I’m going to be okay?”

I resisted sharing my opinion right away. As my new podcast co-host, Carl Richards, says, I avoided the “advice monster” for a few minutes. I asked him: “What do you think? How does that number make you feel?”

His reply was, “Honestly, Reese, if I think about it, that seems like quite a bit. I’m not sure I’ll be able to spend all of that in my lifetime. I mean, I guess things could go super bad, but it seems like enough. But I don’t know, I’m just feeling a little uneasy right now. Like I’m not sure why I’m worried but I just don’t feel like I can spend quite as comfortably as I would like.”

Ah, I thought. A new detail. He feels constrained. The Total Term looks good, but he’s not feeling like he can live life. My thoughts went to liquidity / Liquid Term (his Lt Score).

I redirected his attention back to his scorecard. This time, I asked him to look at the balance of his assets. His Total Term score contained four subcategories: liquidity / after tax (Liquid Term), qualified accounts (Qualified Term), real estate (Real Estate Term), and business equity (Business Term).

He said, “Since the last time we looked at this, I think I’ve actually gone up on most of my numbers. But something feels a little off still.”

I showed him that his liquidity was far less than it was since we last spoke. “Remember how you bought that rental property six months ago and also invested a little into that new startup? Your wealth has increased quite a bit, but you are way less liquid than you were six months ago.”

“Yeah, totally,” he said. “I’m thinking I should probably stay a little bit more liquid than I have been. Every time I have an extra dollar I keep plowing it back into my real estate or my business and it’s just feeling like things are too tight.”

I told him I thought that was a reasonable conclusion. Sometimes we get so focused on wealth maximization, we don’t focus on psychological wellbeing. It’s important to consider both.

I asked him, ”How would that feel, to be a bit more liquid?”

That question led to a great conversation. He was just being a little bit too austere around personal spending at this stage of life and was deploying any liquidity into higher growth assets. For some people that might be a fine outcome that supports their values—but in his case, he was looking for something else. And it had to do with the kids. And experiences—the memories that he was hoping to make with them as life was passing by rather quickly.

I helped him unlock permission to start living a bit more. We talked about where he was going to spend that money, and it was like watching a kid at Christmas.

A few weeks later, I saw a deposit come into his brokerage account which he received from selling some real estate. A few days later he took a bonus and made an additional contribution. I called him and asked him what he wanted to do with that money, especially since we had just discussed him using some of it for some exciting, upcoming experiences. He said that he had made a decision to shift some of his wealth into our portfolio, beyond what he needed for the experiences. He wanted to make sure and protect his overall psychological well-being and had forgotten how important balance was in his overall picture.

Wow, I thought. It’s crazy how a picture can be worth 1,000 words. All this change, all this synergy from a conversation, and a scorecard.

Because I helped build Elements, I don’t always remember how helpful it has been in my client conversations. I told my team after that meeting— “Man, Elements really helps me lower the cost of important conversations.”

I appreciated how I didn’t get into inflation estimates, projections, investment assumptions, etc. I didn’t sell him certainty. I helped him find some peace of mind within the uncertainty, which is part of life.

He was able to observe imbalances in his cash flow, and his overall asset mix. The resulting conversation was super fruitful.

I’m trying to think about how that conversation would have gone using a simulation of future cash flows, or scenario analysis.

Training my clients to embrace some level of uncertainty AND live more presently requires a different set of tools than what advisors have used in the past. I loved how our conversation was lightweight, not overly precise, and that it allowed us to make some creative observations together.

We were able to avoid a lot of rabbit holes (like how the economy would impact investment returns going forward). The majority of our meeting was focused on me listening to him, asking questions, and really unpacking his values and financial purpose.

I believe that psychological well-being should be the North Star of our profession. I’m excited to keep striving at Elements to lower the cost of important conversations. I’m excited to continue to have them with MORE people.