Imagine you’re feeling chronic fatigue. You don’t know what’s up, so you decide to get a comprehensive medical exam. First step, you ask friends for referrals and jump online to do a little research.

Most doctors say the same thing: “I’m very comprehensive, and we look at everything.” But they use medical jargon so it’s hard to differentiate between each provider. Everything feels really generic.

After a few minutes, you discover a new doctor that really stands out. He describes his process:

“We score each area of your health on a scale: low, normal, high, etc. Then we build a one-page plan and monitor these vital signs over time. This helps us be proactive and improve preventative care.”

This doctor feels like someone you can trust. His process is simple, and he’s using words you understand. Plus, he’ll pinpoint the problem area in your body that is scoring low. You schedule an appointment and drive to his office.

He starts with your lungs. He scores your breathing as “atypically low” with a reading of 54% FEV1. He explains what the score means, how he calculates it, and why it’s important. He also explains how it interacts with other systems in your body.

He scores each system in your body using the same process. It’s both interesting and instructive to discover your health through these vital signs.

Your blood pressure is 140/90, which is “high”. Your glucose level, 120 mg/dl, is normal, but your iron levels are “low” at 76 mcg/dl.

The doctor inquires about some unexpected areas—details about your diet, exercise patterns, and your range of motion. He also evaluates other areas from the blood draw, evaluates your sleep, and even asks you some questions about your emotional and mental health.

He examines every area of your body and scores everything. There’s so much to learn, you think. You’re starting to gain awareness about how much your doctor understands the interconnectedness of the body.

This process is comprehensive and objective. These scores also help you have confidence that there is some academic rigor to his process. This helps you feel confident in your doctor.

This doctor is also teaching you what it means to have physical health. You don’t remember any other doctor really taking the time to teach you this. It’s not just one system in your body, it’s the interconnectedness of every system that matters. The doctor hasn’t even diagnosed you yet, but you’re feeling a lot of trust.

Within a week, the doctor sends you a one-page plan. The plan contains advice about exercises, nutrition, referrals to specialists, supplements, one medication, and a summary of all the scores. His recommendations make sense, especially after having seen all of your scores.

As promised, he schedules some follow-ups for accountability. Ongoing, he will collect data and monitor your progress. You’re confident he will uncover even more insights going forward, and optimize your preventative care over time. You have a coach now, and you’re confident this was the right decision.

Over the next few months, your energy starts to return. This comprehensive, score-driven approach identified the problem areas in your body and helped you quickly get back on track.

So—does an approach like this work for personal finances? How might we implement a comprehensive, score-driven, model to monitor financial health?

Financial health is also very complex and interconnected. It requires an equally comprehensive and objective approach to be impactful. This approach has helped me grow my book and have more confidence in the quality of planning I was delivering. At Dentist Advisors, it dramatically sped up my planning process for all the rising star clients I wanted to attract.

I started by identifying which “areas” I wanted to evaluate. What was “comprehensive?” We started with around 20 areas, but over time we simplified it down to a slightly reduced set. Each area corresponds to an area of the financial body: liquidity, retirement accounts, real estate, business equity (if applicable), savings, spending, taxes, debt, insurance, investments, estate, etc. We took each area and applied a score to it, as well as a guideline.

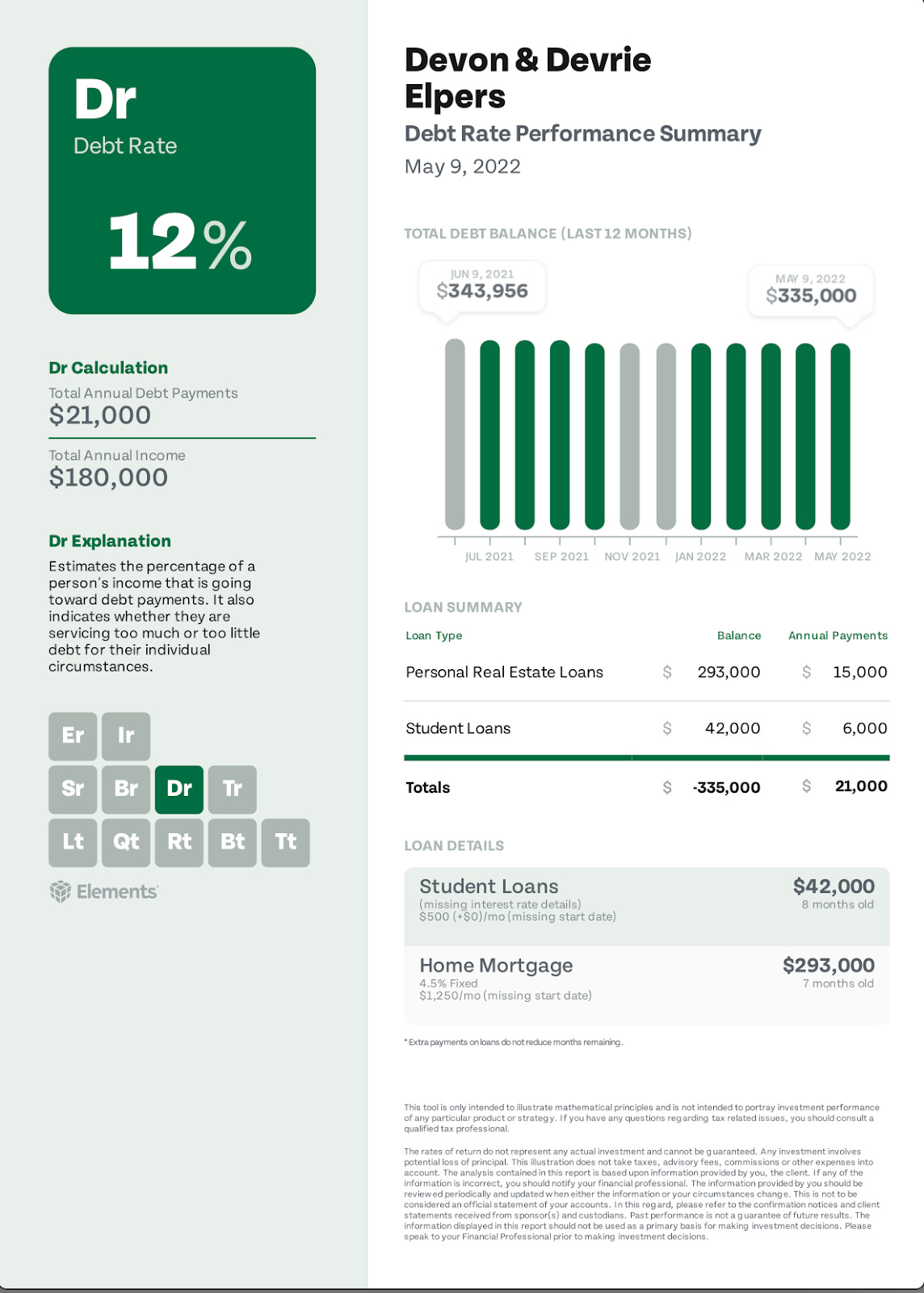

Let’s pull out one example, “DEBT”, so you can see how it works. First, you have to turn the raw data into a ratio. I call it “Debt Rate.” I calculate it this way:

Debt Rate = Total Debt Payments / Gross Income

I currently group debt into 6 separate categories and assign “names” to those categories:

Debt Rate is atypically low: Debt Rate is >0% and < 5%

Debt Rate is low: Debt Rate is >=5% and < 15%

Debt Rate is normal: Debt Rate is >=15% and < 25%

Debt Rate is elevated: Debt Rate is >=25% and < 35%

Debt Rate is high: Debt Rate is >=35% and < 45%

Debt Rate is atypically high: Debt Rate is >=45%

Depending on where I’m at with a relationship, I may prepare an email or make a quick phone call to explain this calculation to my client after sending the report. For example:

Email Subject: Quick Update On Your Debt

Hi Devon and Devrie:

I reviewed your debt and saw your Debt Rate was 12%. We calculate this by taking your total annual debt payments ($21,000) and dividing it by your estimated annual income ($180,000). When I see a Debt Rate between 5% and 15%, I consider this to be low, and like to check in.

A “low” debt rate could be healthy or perhaps unhealthy, so I’d simply like to understand more. When your debt rate is low, this gives us lots of flexibility to plan for future goals and maintain a high savings rate. But sometimes, low rates are temporary, and I’d like to anticipate any changes that might be on the horizon.

Your Debt Rate changes whenever we change your estimated income or your listed debts. Please let me know by responding to this email so we can plan together, do you anticipate any changes that I should know about?

Thanks for any updated information you can provide, I sure enjoy working with you.

I share this example intentionally—although this person isn’t truly in immediate financial “pain,” I’m signaling that I care about preventative care and need to have good data to anticipate adjustments. If the client can contact me IN ADVANCE of making a decision, I can dramatically improve their trajectory. Of course, the message would be different for a client who is “atypically high.”

I review debt and all other comprehensive planning areas 1) during onboarding, 2) at least once a year or 3) if updates to client data push them into a different category during the year. For example, if someone’s debt rate moves from “elevated” to “high”, I wanted to surface that to my attention as soon as possible so I wasn’t surprised about anything.

My team and I used to track all of this data and generate reports inside of spreadsheets and set up reminders inside of CRM tasks. But I’ve since started to automate a lot of the manual steps by building software (Elements).

My confidence increased when I reviewed my entire book with a reliable set of scores. I was able to more easily offer preventative financial care, and diagnose and treat clients faster. Phone calls became much more efficient and instructive to the client. I knew my advice was more objective and less prone to my own bias or bias from my clients.

This kind of transparency increases the number of prospects who are willing to engage with you. Prospects can more easily comprehend the benefits of engaging with this kind of academic rigor. This type of process is more clearly defined and piques curiosity.

Instead of using traditional planning models for all clients, you can monitor financial vitals to increase the number of clients you serve, and selectively choose when to engage in more time-consuming analysis. In my experience, the next generation of rising star clients finds this comprehensive, score-driven interaction to be more intuitive, and valuable than the traditional planning value proposition.

Standards of financial health make advisors more effective. I’m excited for that kind of future: a world where a new advisor is more comprehensive, more objectively informed by scores, and able to focus on deep personalization.

This approach has the power to increase trust and encourage clients to improve their financial health much earlier in their lives.

As always, thanks for tuning in. I’d love to hear your feedback and comments. I’m learning right alongside each of you!

Subscribe to Reese Harper’s Substack here!